Several oil and gas companies around the world pledged to reach net zero in carbon emissions amid the growing urgency to contain climate change. Companies based in Europe have unveiled some of the most ambitious goals in the past few years to align with policy shifts and stakeholder pressures. These goals reflect a strategic pivot towards sustainable energy practices and a recognition of the long-term viability of the energy transition.

However, the financial implications of transitioning to net zero are considerable. Achieving net-zero emissions necessitates a fundamental transformation in how oil and gas companies operate. This includes shifting from fossil fuel extraction to investing in renewable energy sources, such as wind and solar power.

The shift requires operational and financial transformation

The scale of this energy transition is vast, requiring significant capital investment and the development of new business segments, which might not be feasible for some players. Even leading European oil and gas companies, such as Shell, BP and Equinor, have found it tough to sustain capital investments in low-carbon technologies while delivering value to their shareholders. Consequently, these companies have now scaled down some of their targets to focus on capital discipline and profitability.

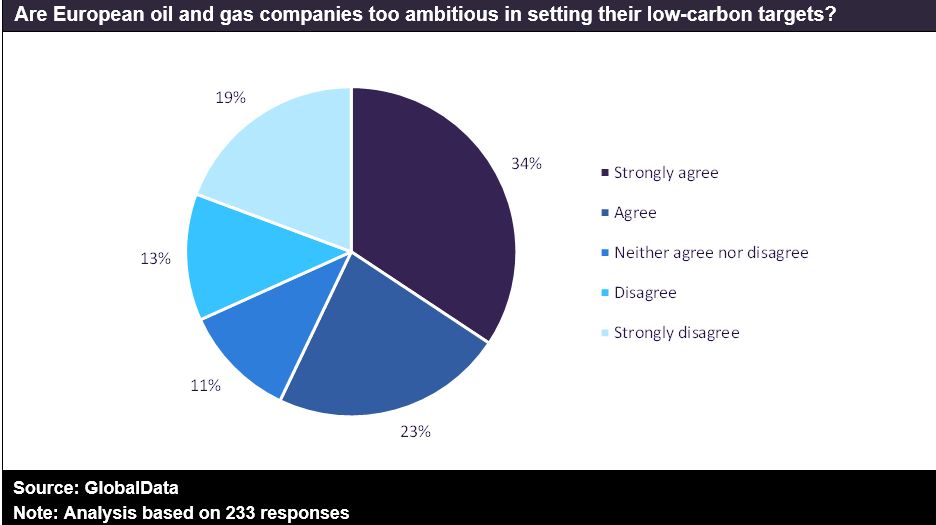

Against this backdrop, GlobalData conducted a survey to gauge public views on the net-zero ambitions of European oil and gas companies. The survey was answered by 233 respondents, with more than one-third strongly agreeing that the goals of these companies were far-fetched. This might be due to the profound operational changes required to be undertaken in the hope that the end-use industries would also shift to new energies at the same pace. Most companies cannot sustain the significant financial commitments needed for the transition that heavily relies on technological breakthroughs.

Overall, almost 60% of survey participants agreed to varying extents that the net-zero goals of European companies are ambitious when setting low-carbon targets. The ambition of these goals is underscored by the significant operational and financial transformations required, the technological innovations needed, and the regulatory and market challenges faced by these companies. They also face potential stranded assets and must navigate the financial risks associated with the shift away from traditional revenue streams.

Around one-third of the respondents were of the opposing view – that the net-zero goals set by European players were quite appropriate. Of these respondents, a large share strongly disagreed with the survey question and opined that these goals were not at all ambitious. The scientific consensus on the urgency of addressing climate change has become a pivotal driver for cutting operational emissions. The need to limit global warming to well below 2 degrees Celsius, as outlined in the 2015 Paris Agreement, requires drastic reductions in greenhouse gas emissions. Hence, these European oil companies are expected to set targets that actively contribute to global efforts to mitigate risks associated with climate change.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataAround 15% of respondents remained neutral over the nature of the decarbonisation goals of European industry participants. European oil and gas companies are increasingly influenced by stakeholders, including investors and the public, who demand stronger action on climate change. This pressure is compounded by European policies favouring a transition to a low-carbon economy, such as the European Green Deal. These external expectations and policy directions necessitate a comprehensive overhaul of traditional business models. At the same time, the market for new energy technologies is still maturing, and industry participants globally face uncertainty regarding the future regulatory landscape and market dynamics. Adapting to these changes while maintaining competitiveness requires a pro-active approach to innovation and a willingness to embrace new business models.